⚓ Legal & Tax Considerations for Yacht Chartering in the EU

Chartering a yacht within the European Union involves a wide range of legal and tax obligations.

In particular, VAT treatment varies significantly by country, depending on where and how the yacht is operated.

🛥️ VAT Regulations in Key EU Member States

- France & Monaco:

20% VAT on charter fees. Partial VAT refunds may be possible if the itinerary includes international waters. - Italy:

22% VAT on charter fees. Reduced rates for international voyages have been abolished. - Spain:

21% VAT on charter fees, plus a 12% matriculation tax on the yacht’s value. - Greece:

VAT rates range from 9.6% to 12%, depending on vessel type and licensing, for yachts with a Greek charter licence. - Croatia:

13% VAT on charter income. Non-EU flagged yachts require a valid Croatian charter licence to operate legally.

⚠️ Key Legal Considerations

- Charter Licences:

Many EU countries require specific charter licences, particularly for yachts sailing under non-EU flags. - VAT Representation:

Non-EU owners may need to appoint a local VAT representative in order to comply with domestic tax reporting obligations. - Flag Choice:

The choice of flag state has major implications for VAT, import duties, and regulatory compliance – including safety and crewing requirements. - Contractual Framework:

Standard contracts such as the MYBA charter agreement are not always sufficient. They often require local amendments or addenda to meet jurisdictional requirements and avoid unenforceable clauses.

(More on this issue →)

📞 Contact Us

We provide strategic, cross-border legal advice tailored to your yacht charter operation in the EU.

- Phone: +49 – 69 / 663 779 0

- Email: mail@der-yacht-anwalt.de

We look forward to supporting you with your EU charter project – from licensing and flag strategy to tax compliance and contract design.

The Yacht Attorney® – Legal clarity across jurisdictions.

Experienced. Independent. International.

Read on the topic in boote EXCLUSIV Ausgabe 2/2014 – Charter als Betriebskonzept?

The subject of yacht charter in EU includes: to what extent has EU harmonised the regulations, especially of tax systems. Thus, offering charter services could soon turn into a legal, fiscal and financial adventure for the one who does not consider and prepare his development plan seriously and professionally.

For this, following four basic questions should be answered:

- How do legal and fiscal policies affect charter yacht in EU? Are there special taxes on yacht?

- Is a charter approval specific to the country required?

- Is a legal entity or representative necessary in the respective country via whom the charter Business can be operated due to fiscal aspects?

- Which VAT is incident upon charter turnover in which country, what is its rate and how can it be transferred?

A complex Matrix should be prepared for these questions:

- Which flag does the yacht have?

- Does the yacht owner (natural person or corporate body) belong to EU or NON-EU?

- Who are the shareholders, if it is a corporate body? Do they use the yacht personally?

- Are the guestscitizens of EU or NON EU?

- Where does the charter tour start – EU or NON EU? Which countries are involved and how? Are their proper routes inside or outside the 12 sm [sea mile] zones of countries or mixed tours?

- What is the duration of tour?

There are legal solutions specific to individual cases; there is no standard solution!

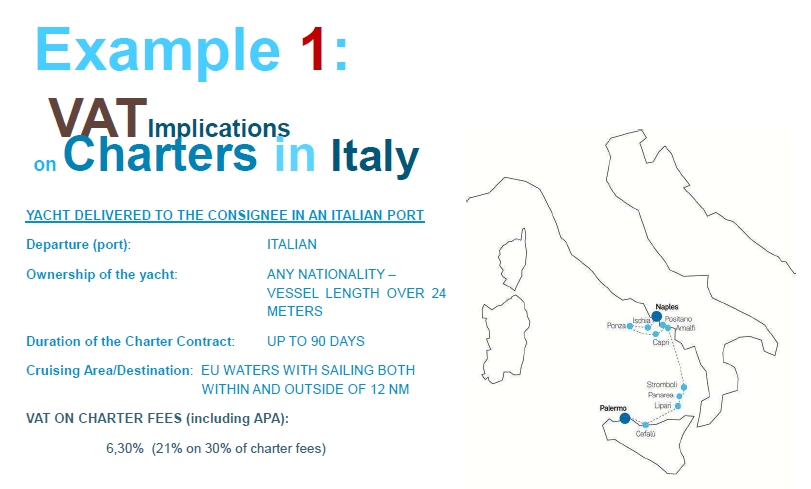

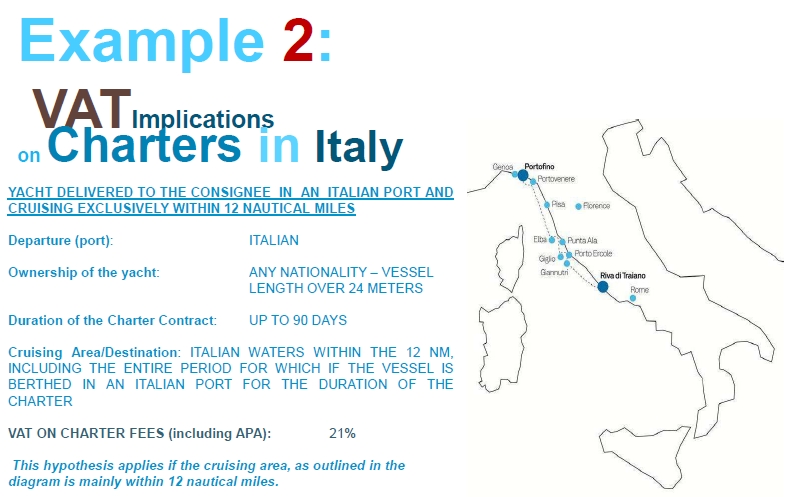

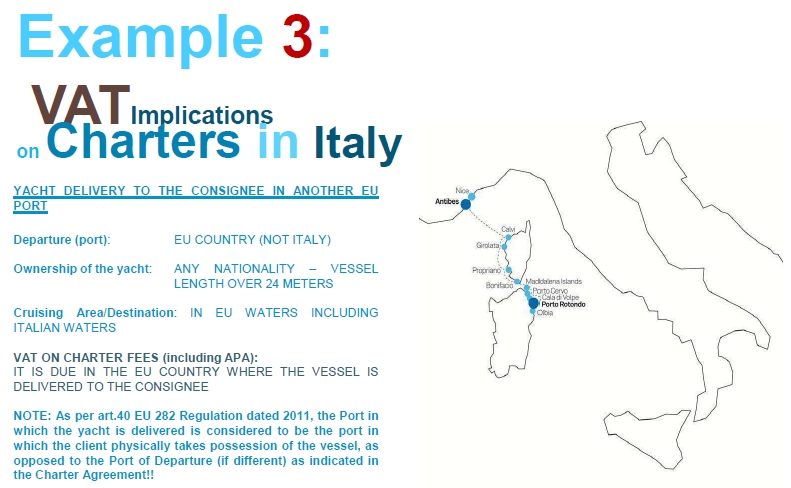

Following is an example only for question IV. Chart V was created in Italy as Croatia was not an EU member then. Today you can apply this to Montenegro instead of Croatia. And since October 2013, the basic Italian VAT on charter is 22%.

Source: SOS Yachting, Milano